- #RETIREMENT INTEREST ONLY MORTGAGE CALCULATOR FULL#

- #RETIREMENT INTEREST ONLY MORTGAGE CALCULATOR PLUS#

- #RETIREMENT INTEREST ONLY MORTGAGE CALCULATOR SERIES#

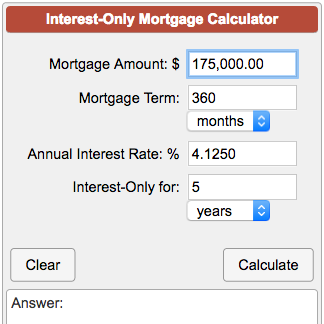

And we even have a free calculator to help you understand how they might work for you. MoneyNerd has rounded up the most important information you need to know about lifetime mortgages and interest-only lifetime mortgages. The interest rate is fixed for the life of the loan.Looking for an interest-only lifetime mortgage calculator? With our No Negative Equity Guarantee, as long as you follow the terms and conditions of the loan, you'll never owe more than the home is worth. If you choose to stop payments, you can't restart them.Ĭan I end up owing more than the home is worth? No - but you can pay some or all of the monthly interest to reduce the overall cost of the loan, and you can stop making payments at any time. No - but you can choose to make partial repayments if you want to manage the amount owed on the loan and interest. You may have cheaper ways to borrow money.

#RETIREMENT INTEREST ONLY MORTGAGE CALCULATOR PLUS#

Interest is charged on the loan amount plus any interest already added, so the amount owed will increase quickly over time unless you pay off some or all of the interest. The loan is usually repaid when you die or move out of the home and into long-term care.

#RETIREMENT INTEREST ONLY MORTGAGE CALCULATOR FULL#

When do I have to repay the full amount of the loan? Minimum additional loan amounts for each releaseĭetermined by your age and property value.

£70,000 or £100,000 for flats, maisonettes, ex-council, ex-housing association or ex-Ministry of Defence properties. You may have to pay an Early Repayment Charge to your existing lender if you remortgage.

Usually the interest rates for a lifetime mortgage are higher than the rates charged for a traditional mortgage. If you're receiving certain means-tested state benefits, taking a lifetime mortgage could impact your entitlement to these benefits.

If you choose to repay all or a significant part of the loan early, there may be an Early Repayment Charge. If you gift the money, the recipient may need to pay inheritance tax in the future. There may be cheaper ways to borrow money.Įven with our Inheritance Protection option, releasing equity with a lifetime mortgage will reduce how much you can leave as an inheritance. If you choose not to repay any interest until you die or move permanently into long-term care, the interest can rapidly build up over time. Whatever happens you'll never repay more than the value of your home when it is sold - even if that's less than the amount owing. Part of the value of your home can be passed on if you choose our Inheritance Protection option. So long as the new property is acceptable to us. With equity release, you don't need to downsize and can stay in your home until you die or move permanently into long-term care. You can also choose to repay part of the original loan. If you prefer, there's an option to repay some or all of the interest. Unless you choose otherwise, there's nothing to repay until you die or move permanently into long-term care. You can use the money you release for home improvements, helping children buy their first property or increase your income in retirement.

#RETIREMENT INTEREST ONLY MORTGAGE CALCULATOR SERIES#

When you release equity with one of our Lifetime Mortgages, you can take a lump sum in one go or as a series of smaller lump sums when it suits you.

0 kommentar(er)

0 kommentar(er)